Advantages and Disadvantages of Leverage

This methodology of trading allows traders to gain greater exposure to the market with relatively small amounts of capital the leverage ratio. Advantages and Disadvantages of Leverage.

.jpg)

Types Of Leverage Advantages And Disadvantages Analytics Steps

Risky form of finance.

. Connectivity is one of the most fundamental benefits of social media. It is indeed rewarding but involves a great deal of risk. Low cost debt especially when interest is low would increase the return of equity relative to the return of assets.

Shapiro 2006 describes the emergence and growth of the market for derivative instruments can be traced back to the willingness of risk. Because leverage is a multifaceted financial tool it is somewhat complex in nature and can increase both gains and losses when. The Advantages and Disadvantages of Leveraged ETFs.

All have to manage the risks of leverage when used properly to make a profit and otherwise huge loss for the investors. In too many. Be it professional traders or beginners.

In totality it has its advantages under good economic situations and at the same time it is not free from disadvantages. L everaged ETFs it seems are back in fashion. For this very reason its important to make sure you understand the disadvantages of leverage and take care to ensure you dont fall victim to overexposure when the markets inevitably turn sour.

The primary and widest feared drawback of leverage is its potential to scale up losses when the going gets tough. This section covers the most important advantages of this strategy. Debt is a source of funding that can help a business grow more quickly.

The following are the benefits and drawbacks of social media as well as how it affects our lives on a daily basis. The drawbacks of the trading with leverage are. Increased financial leverage can lead to higher returns on equity during periods of economic expansion but it can result in missed loan payments and possible bankruptcy during economic downturns.

Being able to do this comes with great returns however there are certain risks involved. For this reason we point out one by one the main advantages and disadvantages that operating leverage offers. High degrees of leverage help traders maximize the potential of their risk capital and turn minimal investments into substantially larger returns.

In addition to that a leverage ratio is a reflection of the. Advantages And Disadvantages Of Financial Leverage. Another advantage that stems from the first one is the potential transparency that can derive from the application of such simple rules.

The following are some of the key advantages and disadvantages of leveraged trading. Allows you to buy the largest possible business. Leverage is easily available with brokers and offers high returns when traded accurately.

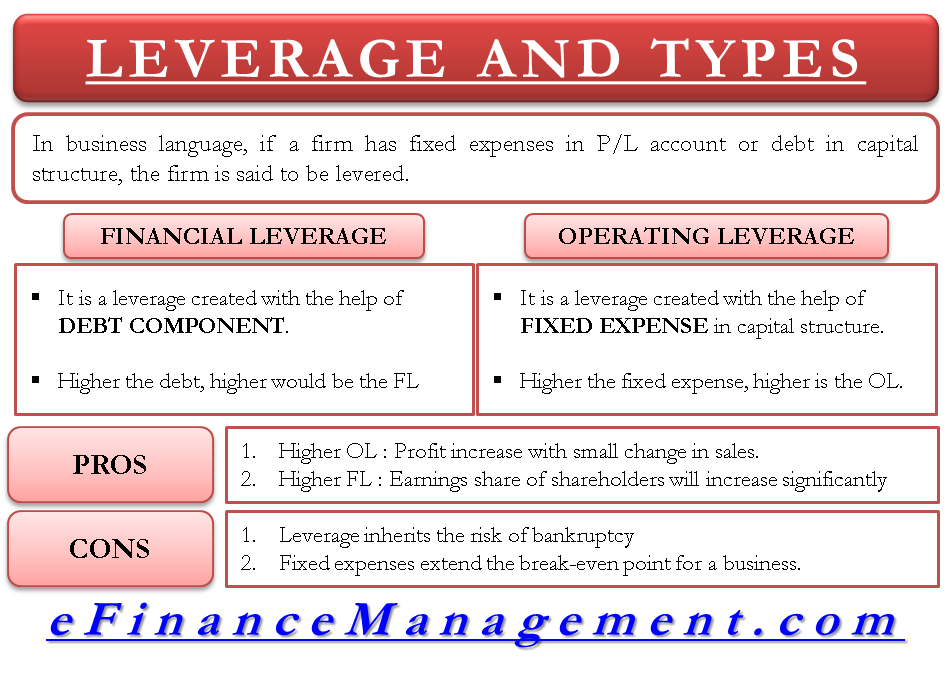

The greater the applied leverage the. Every small business owner needs to understand the advantages and disadvantages of leverage. Advantages and disadvantages of Operating Leverage.

Both approaches offer the same advantages first of all the extreme simplicity that should allow both banks and supervisors to apply them with ease. Disadvantages of trading with leverage. When used correctly leveraged buyouts can be an effective way to finance a small business acquisition.

For this reason we point out one by one of the main. Otherwise the risk of the company obtaining a bad economic situation is quite high. Like the other management decisions of a company operating leverage will be functional to the extent that internal and external conditions are aligned.

Investment on securities such as shares debentures bonds are profitable as well as exciting. A disadvantage would be if the debt becomes too costly it reduces the return. Take OL and the operating profits can see a sharp increase with a slight change in sales as most parts of the expenses are stagnant and cannot further increase with sales.

Operating leverage like the other management decisions of a company will be functional to the extent that internal and external conditions are aligned otherwise the risk of the company obtaining a bad economic situation is quite high. In forex capital efficiency is the comparison of how much money is being risked relative to potential profits. It has the ability to connect an unlimited number of people from any location at any time.

As with any other financial instrument leverage has advantages and disadvantages that you should be aware of before employing it in your business or personal investments. Leveraged finance is even more powerful but the higher-than-normal debt level can put a business into a state of leverage that is too high which magnifies exposure to. Following the stock market crash in 20089 leverage was a dirty word.

Advantages Enhances Capital Efficiency. One of the main advantages of using an LBO is that it enables entrepreneurs to use financial. Potential Scale of Losses.

Advantages of Higher Leverage.

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Accounting Books

Types Of Leverage Advantages And Disadvantages Analytics Steps

Leverage Ratios Accounting Education Financial Strategies Leverage

Leverage Types Financial Operating Advantages And Disadvantages

No comments for "Advantages and Disadvantages of Leverage"

Post a Comment